The recent signing of a lithium mining lease between the Ghanaian government and Barari DV Ghana Limited marks a significant milestone in the country’s mining sector.

This agreement, involving the exploitation of lithium in the Ewoyaa area, has set new standards in terms of fiscal terms and community engagement compared to typical mining agreements in Africa. I take a comparative look at this landmark deal and how it stacks up against other lithium projects across the continent.

*Ghana’s Forward-Thinking Lithium Deal*

The Ghana lithium deal stands out for several reasons.

Firstly, it offers an increased royalty rate of 10%, doubling the standard 5% typically observed in similar agreements.

Secondly, the state’s free carried interest has been raised from 10% to 13%.

In addition to these terms, the Minerals Income Investment Fund (MIIF) will acquire a 6% stake in the mining operation, and a 3.06% stake in the company’s parent entity, showcasing the government’s commitment to leveraging its natural resources for broader economic benefit.

Notably, 1% of the revenue is allocated to a Community Development Fund, aimed at ensuring that the local communities directly benefit from the mining activities .

*A Pan- African Perspective-Other African Lithium Projects*

In Africa, lithium mining is gaining traction with significant projects underway in Zimbabwe, Namibia, Mali, and the Democratic Republic of Congo (DRC). However, specific fiscal details of these projects are often not as transparent or publicly available as Ghana’s deal.

1) *Zimbabwe’s Arcadia Project*.

As Africa’s projected leading lithium producer, this project carries significant weight, but lacks detailed public fiscal terms.

2)*Namibia’s Karibib Project*.

This project is attracting attention from European battery manufacturers focused on environmental, social, and corporate governance. However, like Zimbabwe, specific fiscal terms aren’t detailed.

3)*DRC’s Manono Project*.

A major $454-million initiative, the Manono Project’s fiscal specifics, similar to other African projects, are not publicly detailed.

4) *Mali’s Lithium Endeavours*.

Mali’s venture into lithium mining is noteworthy, but like other African projects, detailed fiscal agreements are not publicly available. However, it’s essential to recognise that political instability in Mali poses risks to project development, potentially impacting investment and operational decisions .

*Analysis and Implications*

The Ghana lithium agreement, with its transparent and comparatively more favorable fiscal terms, sets a new precedent in the realm of African mining deals. While it faces criticism for perceived colonial undertones and the lack of a competitive bidding process, the deal’s strengths lie in its emphasis on higher financial returns and community development.

On the other hand, the lack of detailed fiscal information for other major lithium projects in Africa makes direct comparisons challenging. Each project operates within its unique socio-political and economic context, influencing its overall structure and benefits.

In conclusion, Ghana’s lithium deal represents a significant shift in how African nations could negotiate mining agreements, potentially influencing future deals across the continent. By prioritising higher state participation and community benefits, Ghana sets a benchmark for others to follow.

However, the diverse landscape of African lithium mining projects, each with its unique challenges and opportunities, suggests that there is no one-size-fits-all approach to such agreements. As the continent’s lithium market continues to evolve, it will be interesting to observe how these different approaches shape the future of mining in Africa.

Long live Ghana

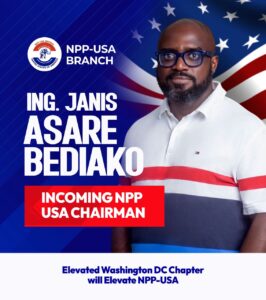

Long live NPP

Long live NPP UK

*Kwaku Bimpeh*

*Director of Communications,*

*NPP UK*